The single purchaser report

Is buying a home harder if you're on your own?

We thought it was a question worth answering so we dug into our own data and a survey of UK homeowners and would-be homeowners to get the lowdown.

You may be surprised at what we found.

Is it getting harder to buy a house on your own?

The majority of people think it's harder to buy alone than it was 10 years ago

According to our survey, six in ten (62%) agree that it's much harder to buy a home on their own than it was a decade ago, but are they right?

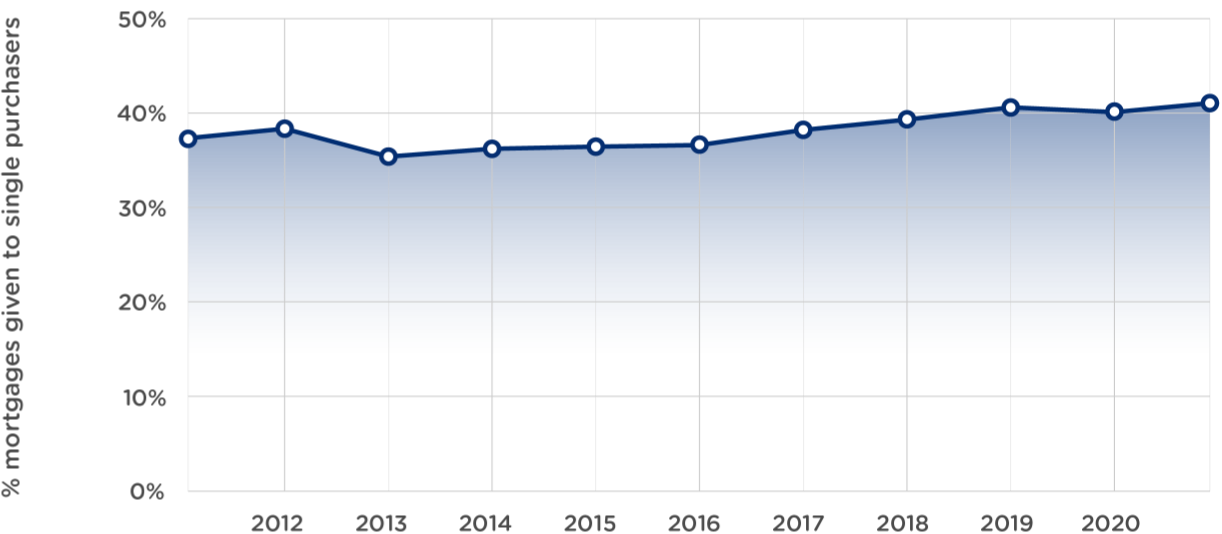

The percentage of mortgages given to single purchasers has actually risen slightly since 2011 - from 38% to 41%.

Although it dropped to under 36% in 2014, it has risen every year since, other than 2020, perhaps showing the effects of the pandemic.

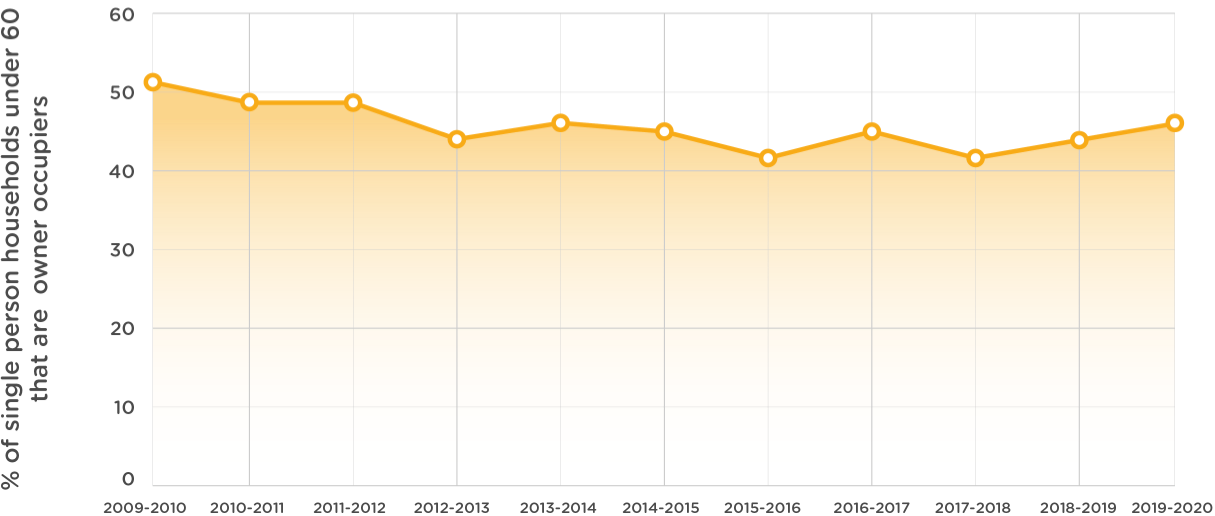

But the percentage of people under 60 living alone who own their home dropped by 5% between 2010 and 2020.

Data from the English Housing Survey shows that only 46% of single person (under 60) households were owner occupied in 2019-2020, compared to 51% in 2009-2010.

What age are single purchasers who can afford to buy?

The average age that people think they'll be able to buy alone.*

We asked people who don't currently own their own home at what age they thought they would be able to afford to become homeowners, if they were to buy alone.

How does that compare to the ages of the people who have managed this already?

* Excluding respondents who answered 100 or more

In fact, our data reveals that last year, 82% of single purchasers were under the age of 45, and 46% of single purchasers were between the ages of 26 and 35.

up to 25

1449

26-35

9849

36-45

6237

46-55

2856

Over 55

914

Where is it hardest to buy on your own?

1. Bristol 74%

2. Belfast 72%

3. Leeds 70%

4. Plymouth 67%

5. London 63%

The hardest cities to buy a home alone.

According to our survey, these are the cities where residents were most likely to say that it would be impossible to buy a home without the help of a partner.

You need to earn over £140k to buy the average London house on your own.

Using the average price of a property and assuming lenders will offer you a mortgage rate of 4.5x salary, the below reveals how much a single purchaser would need to earn in ten major UK cities in order to buy alone.

| City | Average property price (£) | Earnings required (£) |

|---|---|---|

| 1. London | £705,783.00 | £141,156.60 |

| 2. Brighton | £456,829.00 | £91,365.80 |

| 3. Bristol | £363,878.00 | £72,775.60 |

| 4. Southampton | £323,732.00 | £64,746.40 |

| 5. Edingburgh | £312,366.00 | £62,473.20 |

| 6. Cardiff | £285,201.00 | £57,040.20 |

| 7. Norwich | £285,201.00 | £57,040.20 |

| 8. Leeds | £252,613.00 | £50,522.60 |

| 9. Nottingham | £247,416.00 | £49,483.20 |

| 10. Birmingham | £239,723.00 | £47,944.60 |

Is there a gender gap for single purchasers?

63% of people disagree that it's harder for a woman to buy alone.

According to our survey, only two in five (37%) people agree that it is harder for women to buy a home alone, but how does this compare to our data?

Over 60% of single purchasers are men, meaning that women are significantly less likely to buy on their own.

Although the gender pay gap has declined by approximately a quarter* since 2011, this isn't reflected by the single purchaser gender gap - the split has remained at roughly 60-40 throughout the same period.

*Source: ONS

Is it harder to buy a property if you are single?

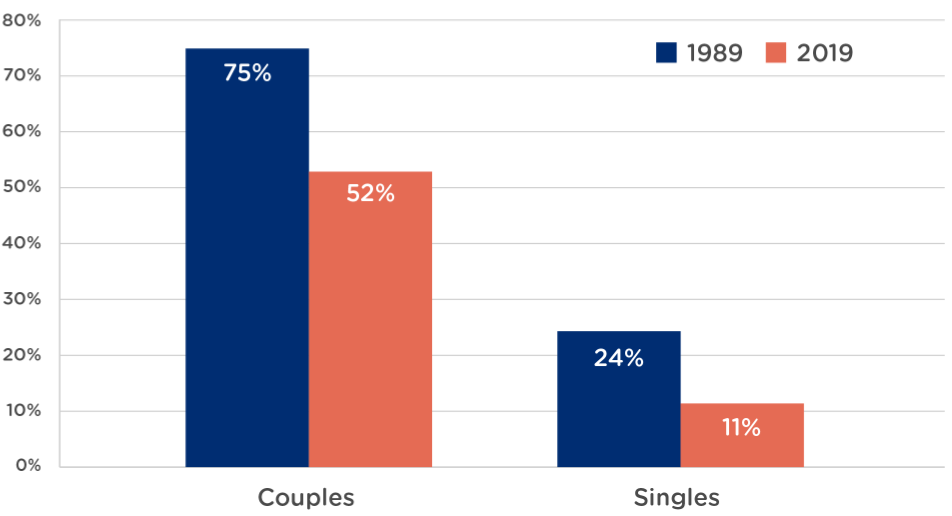

A single person aged 25-34 is almost 5 times less likely to own their own home than a couple the same age.*

In 2019, only 11% of single 25-34 year olds owned their own home, compared to 52% of couples in the same age group.

This gap has got bigger over time - in 1989 single people this age were only 3 times less likely to own than couples.

When surveyed, less than 13% of people disagreed with the idea that it was harder for single people to buy their own home.

*Source: Resolution Foundation